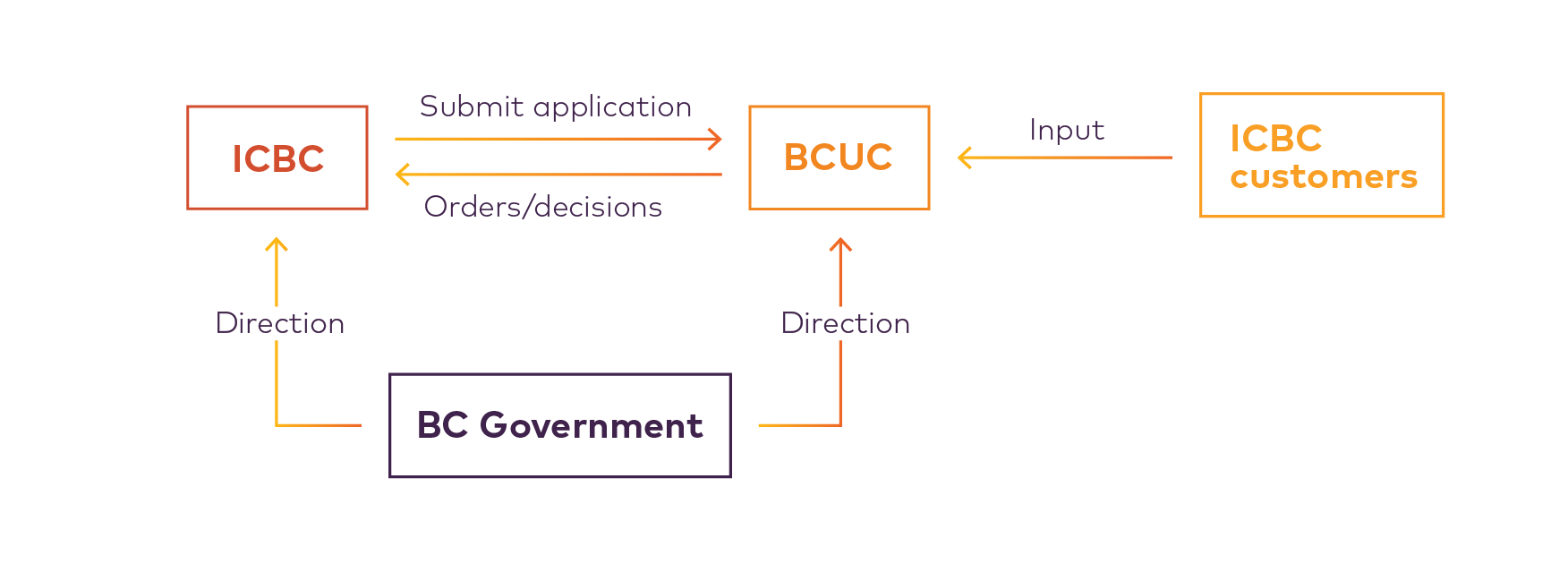

The BCUC is responsible for regulating ICBC's basic insurance rates under the Insurance Corporation Act and the Utilities Commission Act. We are responsible for ensuring that ICBC provides basic insurance to customers in a manner that we consider to be adequate, efficient, just, and reasonable.

ICBC is a provincial Crown corporation established and owned by the BC government. The BC government may direct ICBC and/or the BCUC to perform certain tasks related to basic automobile insurance. These directives can be issued to the BCUC through special directions or Orders in Council (OIC), on specific actions we must take when regulating ICBC.

These include changes to how ICBC's basic insurance premiums are determined (rate design), rate changes for ICBC basic insurance premiums, and the provision of basic insurance to ICBC’s customer base as a whole.

In 2004, the BC government established Special Direction IC2, which has been amended from time to time. It requires ICBC to submit a general rate change application to the BCUC every year, unless directed otherwise. For 2023, it also requires the BCUC not to decrease ICBC’s basic insurance rates.

Subject to directives from the BC government, the BCUC is responsible for regulating:

The BCUC requires ICBC to submit annual and quarterly reports, rate design filings, information technology (IT) reports on capital projects and expenditure plans, and performance measure reports to the BCUC.

The BCUC requires ICBC to submit Annual Reports about their financial results related to Basic insurance and organizational governance information. ICBC files Annual Reports to the BCUC once a year approximately five months after ICBC's March 31 fiscal year end.

ICBC reports quarterly on their financial and operating results, changes to capital, and estimated claims and claims costs.

In 2018, the BCUC directed ICBC to file an annual report that outlines the results and impact of their new rate design starting in 2021.

ICBC's IT capital projects maintain or improve ICBC's systems to provide basic insurance rates and service. ICBC provides information on IT projects that exceed a threshold of $2 million. The BCUC determined the threshold after an open and transparent review process and approved it by Order G-139-18. These reports are confidential and unavailable for viewing as they contain budget information that, if disclosed, could result in economic harm to ICBC or third parties.

ICBC files annual IT Expenditure Plans to the BCUC to provide transparency about actual and planned IT capital expenditures that exceed a threshold of $2 million, and the resulting depreciation and amortization that are reviewed in Basic insurance rate change applications.

ICBC often files IT Capital Expenditure Plans with their revenue requirement application. In those instances, the reports will be posted on the BCUC's Proceeding page.

ICBC files an update to the IT Strategic Plan once every three years, or following any material change to the corporate and/or IT strategy.

The BCUC directs ICBC to provide performance measures reporting to assess whether ICBC's Basic insurance service to customers is adequate, efficient, just, and reasonable. In these reports, ICBC address its corporate strategy, performance measures, and metrics over the coming years. Unless otherwise specified, ICBC files their performance measures as part of their annual revenue requirement proceedings. The BCUC reviews these during the proceeding.

The BCUC may use L-letters to contact the entities it regulates on matters that do not relate to a specific proceeding or application. The following list includes the latest communications between the BCUC and ICBC.

| Date | Document Number | Title / Description |

|---|---|---|

| 2020-06-17 | L-32-20 | Financial condition of Basic insurance business |

| 2020-03-23 | L-14-20 | Impact of COVID-19 on ICBC Basic policyholders |

| 2018-07-16 | L-18-18 | Request to Further Streamline ICBC's Statutory Fiscal Year-End Reporting Requirements |

| 2017-07-28 | L-17-17 | Proposal to Discontinue Requirement for Annual Basic Insurance Minimum Capital Test (MCT) Certificate |

| 2016-07-21 | L-18-16 | Filing of the Insurance Business Capability Project Information Technology (IT) Capital Report |

The BCUC conducts public, open, and transparent review processes of the applications it receives from ICBC. To see in progress and completed ICBC proceedings, please see our Proceedings page. For a list of the BCUC's decisions on ICBC applications, please visit our Orders and Decisions page.

Proceedings Orders and Decisions